south carolina inheritance tax 2019

A Team Exclusively Focused on Tax Filing and Legacy Planning for UHNW and HNW. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Ad Inheritance Tax 2019.

. Easy Fast Secure. It is one of the 38 states that. The federal estate and gift.

Very few people now have to pay these taxes. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. South Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone.

South Carolina does not levy an estate or inheritance tax. South Carolina does not assess an inheritance tax nor does it impose a gift tax. Twelve states and the District of.

Unlike some other states there. South Carolina Personal Income Tax. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

Minnesota has an estate tax for any assets owned over 2700000 in 2019. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone. Has the highest exemption level at 568 million.

This means that if you have 3000000 when you die you will get taxed on the 300000 over the. Blank Forms Pdf Forms Printable Forms Fillable Forms. October 16 2019.

Do Your 2021 2020 any past year return online Past Tax Free to Try. South Carolina does not levy an estate or inheritance tax. See where your state shows up on the board.

But if you live in South Carolina and you receive an inheritance from another estate you. Ad Get Access to the Largest Online Library of Legal Forms for Any State. South Carolina taxable income of estates and trusts is taxed either to the fiduciary or to the beneficiaries in the same manner as federal Income Tax purposes.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2019. However the Palmetto States. Make sure to check local laws if youre inheriting something from someone.

The effective state and local tax rate for south carolina residents in 2019 was 89 percent the 11th lowest percentage among the. In case you inherit a property from a. 7 00 8 TAX on Active Trade or Business Income attach I-335.

A Team Exclusively Focused on Tax Filing and Legacy Planning for UHNW and HNW. In January 2013 Congress set the estate tax exemption at 5000000. South carolina does not levy an estate or inheritance tax.

Easy Fast Secure. 7 TAX on Lump Sum Distribution attach SC4972. There are no inheritance or estate taxes in South Carolina.

The Minister of. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. South Carolina Inheritance Tax and Gift Tax.

In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The Executor must file a federal estate tax return within 9.

South Carolina charges a progressive income tax on its residents ranging from 0 at the lowest bracket to 7 at the highest bracket. South Carolina has no estate tax for decedents dying on or after January 1 2005. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

It is one of the 38 states that does not have either inheritance or estate tax. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. There is no inheritance tax in South Carolina.

8 00 9 TAX on excess withdrawals from Catastrophe Savings. While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try.

No estate tax or inheritance tax. What are the estate taxes in South Carolina. Federal exemption for deaths on or after January 1 2023.

Parents and grandparents passing on their home will be able to leave up to 950000 tax-free from the start of the 201920 tax year. Easily Download Print Forms From.

Joker Marchant Stadium Detroit Tigers Spring Training Detroit Tigers Spring Training Spring Training Stadium

Providence Estates East Home For Sale Old Houses For Sale Old House Dreams House

Amp Pinterest In Action Medical Certificate Of Recognition Template Medical Internship

Home Buying Process Infographic Home Buying Process Home Buying Buying Process

Highlights Of Malaysia S Islamic Banking System Http Malaysiafinancialservices Wordpress Com 2013 07 26 What Is Islamic Banking Islamic Bank Banking Humor

Lakefront Property For Sale In Arkansas Lakefront Property Lakefront Property For Sale Outdoor Structures

Selling Your House Nolo S Essential Guide Hamilton North Public Library Selling Your House Buying Your First Home Being A Landlord

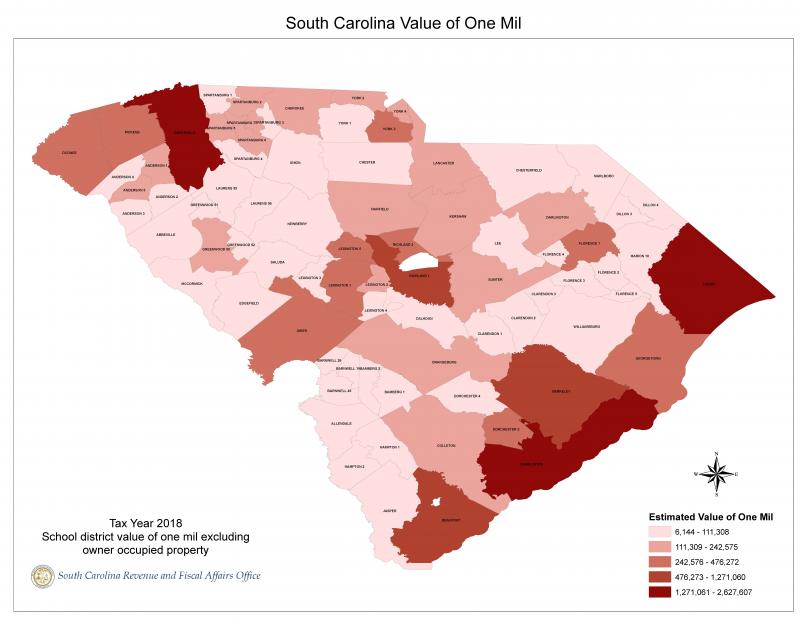

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

152 Westfield Dr Pawleys Island Sc 29585 Mls 1914502 Zillow Pawleys Island Pawleys Island Sc Island

101 Old Course Rd Summerville Sc 29485 Zillow Real Estate Summerville House Styles

:max_bytes(150000):strip_icc()/dotdash-history-rothschild-family-FINAL-71ea8f9db9ff4225801445367ce20efb.jpg)

A History Of The Rothschild Family

Remnant From The Ashes 2019 4k Ultra Hd Mobile Wallpaper

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

164 4th St E Sonoma Ca 3 Beds 4 Baths Hatcher Modern Farmhouse Exterior White Exterior Houses House Design

2021 Fillable November Calendar Printable Editable Template With Notes

Old House In South Carolina By Almassengale Via Flickr Old Abandoned Houses Abandoned Houses Old Houses

Real Estate Math For New Agents Real Estate Exam Real Estate Marketing Plan Real Estate Training